What should I do with money that I don’t want to risk in the stock market? That is one of the most common questions that I hear. Interest rates are higher now than they’ve been in about 15 years. This brings opportunity. You can now walk into your local bank and buy a CD or put your money in a money market and earn a few percent interest on your money. Easy, right? Well, without knowing your options, you may be missing out on better returns.

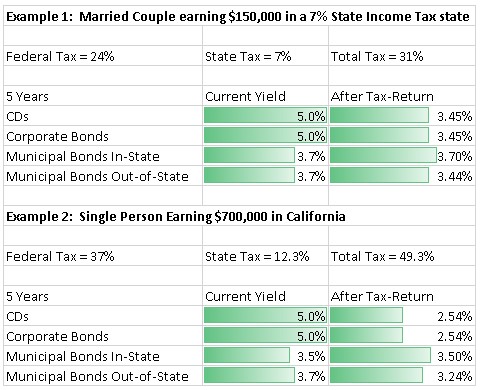

CDs and Corporate bonds are taxed as ordinary income, meaning that you pay federal and state taxes. If you fall in higher tax brackets, your federal tax rate may be up to 37%. State income taxes vary state by state. It’s not uncommon for states to have state income taxes higher than 7%. California tops the list at 12.3% for its highest earners. However, Alaska, Florida, Nevada, South Dakota, Texas, Washington, Wyoming, Tennessee, and New Hampshire all have no state income tax.

You don’t have to pay federal income tax on municipal bonds. For most states, if you own municipal bonds in the state where you live, you don’t have to pay state income tax on the interest. Illinois, Iowa, Oklahoma, and Wisconsin currently make you pay state income tax on that interest, no matter what municipal bonds you buy, with a few exceptions.

I used A-Rated corporate and municipal bonds for this exercise to try to make it as apples to apples as I could. In the first example, the after-tax returns on the CDs, corporate bonds, and Out-of-State Municipal bonds are all about the same. The in-state municipal bonds are the best option.

This second example is a bit extreme, but it does go to show how much taxes can eat away at your returns. Even though the CDs and corporate bonds have higher current yields, the municipal bonds are the best option, especially California municipal bonds.

Keep in mind, this is only for money that’s held in non-retirement accounts. In retirement accounts, such as IRAs, Roth IRAs, 401Ks, and 403Bs, interest is not taxed. The preferential tax treatment of municipal bonds is useless in these accounts. For these accounts, it’s best to choose the higher pre-tax returns. These calculations differ depending on what tax bracket you are in and what state you live in. There are also some cities and other municipalities that have separate income taxes as well. This also assumes that you can find a CD that pays a nationally competitive rate. Too often people will walk into their bank and purchase whatever CD that their bank is offering. A quick online search of a handful of banks shows that they are currently offering 2.5% to 5.3%. It’s best to shop around.