Current Interest Rates

The Federal Reserve has begun lowering short-term interest rates, as expected. They started with a 1/2 percent cut and are expected to continue to lower rates through 2025. Longer-term rates went lower in anticipation of these cuts, but have since gone higher.

The 10 year US Note had gone below 3.65%, but is now sitting at 4.21%. This can be attributed to stronger than expected economic data and concerns that neither candidate in next month’s presidential election seems concerned about the federal deficit or debt.

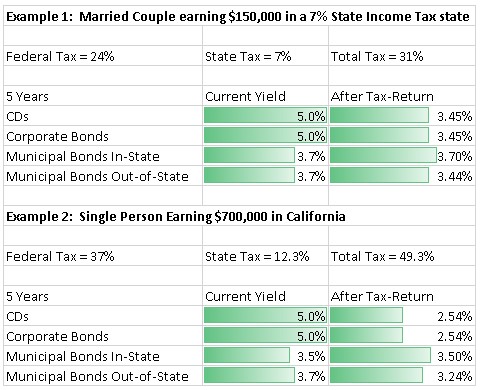

Looking at the data below makes me think that the best value right now is in intermediate and longer-term municipal bonds. Interest from municipal bonds are typically free from federal taxes. In almost all states, if you buy bonds in the state that you live, that interest is also not taxed. I used a 30% total tax rate for the comparisons below, 24% Federal and 6% State. The higher your income and tax rate, the more valuable that interest free income is worth.

Interest Rates That You Receive

| 1 Year | 5 Years | 10 Years | 20+ Years | |

|---|---|---|---|---|

| US Government Bonds | 4.30% | 4.07% | 4.21% | 4.62% |

| High Quality Municipal Bonds | 3.05% | 3.50% | 4.15% | 4.5% |

| Municipal Bonds- Tax Equivalent | 4.36% | 5.00% | 5.92% | 6.43% |

| CDs | 4.10% | 3.90% | 4.05% | N/A |

| High Quality Corporate Bonds | 4.50% | 5.00% | 5.30% | 5.60% |

Interest and Dividends From Funds

| High Yield Corporate Bond Fund | 6.65% |

| Preferred Stock Fund | 6.07% |

| High Quality Dividend Stocks | 4.25% |

Interest Rates That You Have to Pay

| 30 Year Mortgage | 6.75% |

| 15 Year Mortgage | 6.00% |

| Credit Card APR | 23.37% |