Stock market indexes have had a tremendous run since the lows of October 2022. The S&P 500 has gained around 60% in less than two years. The annualized return since that low has been an astonishing 28.5%, far outpacing the historical gain of about 10% per year. If these returns were the norm, I would have a very easy job.

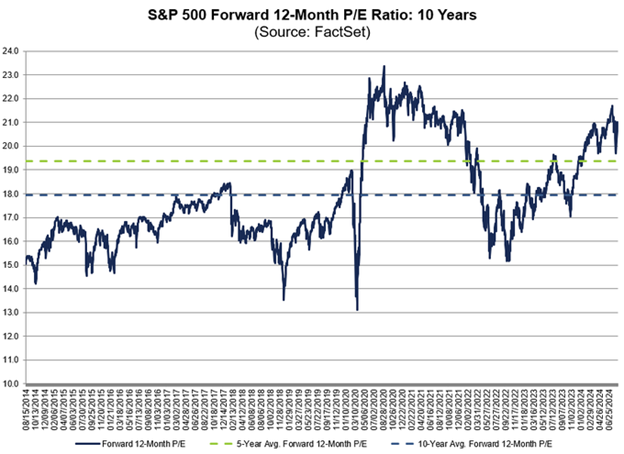

The Price/Earnings Ratio, or PE ratio, tells you how much you are paying for each dollar of earnings of a stock or stock market index. The current PE ratio for expected earnings of the S&P for the next year is about 21. The chart below shows where that falls over the past 10 years. We are 8.2% over the five-year average and 17.3% over the ten-year average.

To justify a higher earnings multiple, one of two things have to happen:

Option 1 is that companies grow their earnings at a greater pace than normal. Earnings growth for the S&P is projected to be 16% by the end of 2025. Those are lofty expectations as the historical average is around 10%. A lot of earnings growth is expected from the adoption of Artificial Intelligence, so this very well may happen.

Option 2 is that the stock market will have subpar returns over the intermediate future. Currently, the market is justifying its higher than average Price/Earnings ratio because of that higher than expected earnings growth.

I’m not necessarily calling for a stock market crash, but I am being a little cautious. Long-term time horizons smooth out risk. Selling out of stocks now with the idea of buying them back at a cheaper price is usually a loser’s game. Selling appreciated assets also creates capital gains. Many clients have significant capital gains. It simply doesn’t make sense to sell your holdings and pay taxes, hoping to buy them back a little lower. August through October is on average the weakest stretch of the year. That being said, I am taking my time with any new money or cash coming from bonds that normally would be allocated to stocks. Rest assured, your allocations will soon be where they need to be. With risk-free government bonds paying around 5%, I just may take some extra getting there.